It appears to have been a happy new year for everyone except for Holborn Assets investors. Unfortunately, this is not a surprise!

The same investors who have relied on advice from a company making poor recommendations in the name of double digit commissions. Evidently, as I mentioned in my previous post, it is to the detriment of the client being placed in questionable investment vehicles.

Holborn Assets have received their 10%+ commission. The financial adviser has been paid their commission. And the client has had their hard earned savings placed in unregulated investments.

I’ve said it once and I’ll say it again, “f*** the clients”. This is yet another prime example of this being the ethos adopted by this diabolical financial advisory firm.

Holborn Assets have in excess of £60,000,000 of client funds invested in this product. Whilst it’s failing, let’s take a look at to why clients have been placed in such a questionable investment…..

In the words of Simon Parker

Simon is busy launching lavish incentives to encourage the financial advisors, who are allegedly “ethical & independent”, to place as much of the clients money into these products as possible. #SoundAdvice

So what do these incentives look like, what is the client paying for??

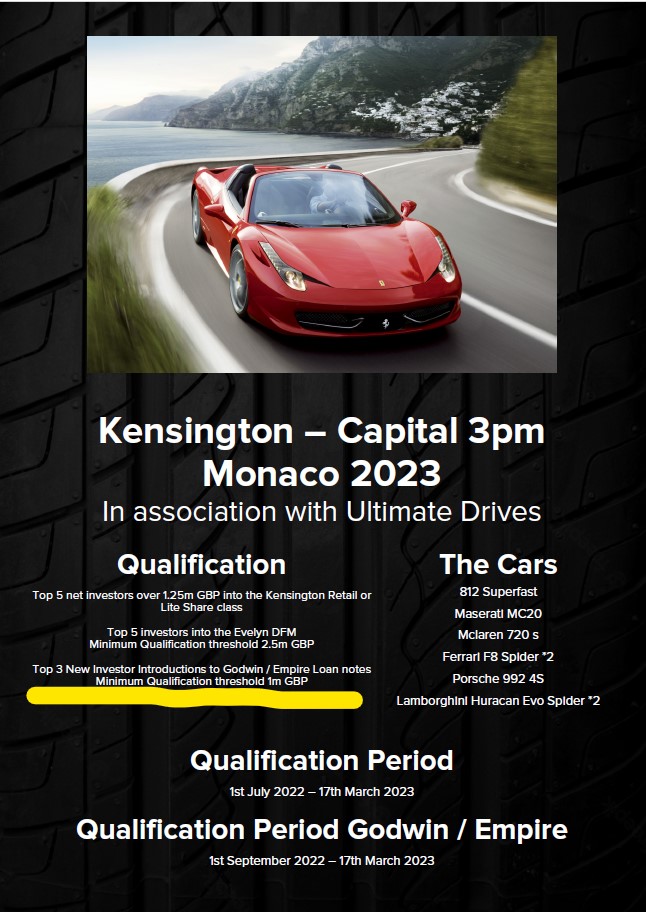

Firstly, the flyer attached to the above email is as follows…..

Other incentives include…..

All expenses paid trip to Monaco driving a fleet of supercars around the French Riviera.

An all expenses paid ski trip…

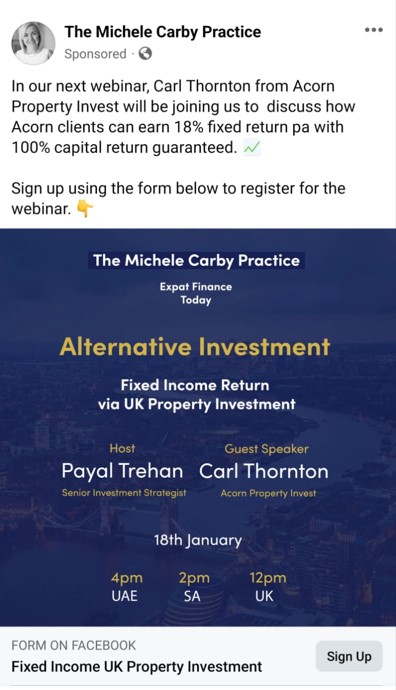

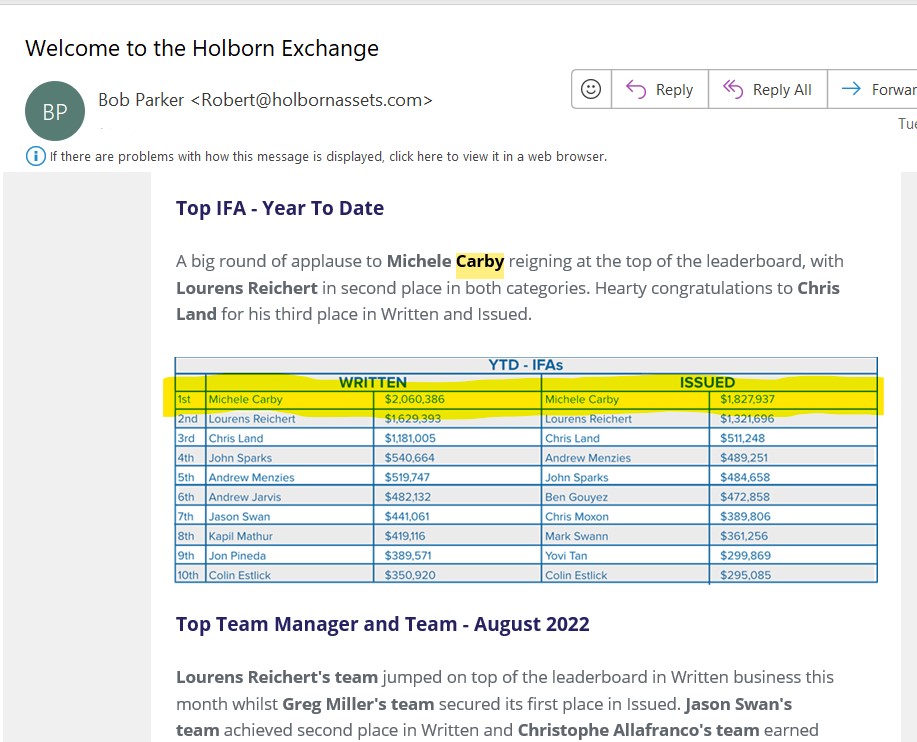

Meanwhile, whilst all this is going on Holborn’s “number 1 advisor” is busy ploughing millions of clients funds into an equivalent high risk unregulated product, with zero regard for doing what is best for the client.

Millions from client = Millions in commission!

Q. 18% per year return with a capital guarantee? Where have we heard those sorts of reassurances before 🤔

A. The same investment that’s failing to pay it’s investors.

E.G. the below was distributed to the whole of Holborn Assets via Nadia Marks of Capital3pm in June 2022.

As I said in my last post, whilst Holborn advisers are distracting you with expensive watches and shiny cufflinks…. Focus on what they’re not telling you.

As they say, if it sounds too good to be true…..

For anyone who may find this useful, here are the internal download documents from above presentation:

Leave a Reply